tennessee inheritance tax rate

For example if you inherit a traditional IRA or a 401k youll have to include all. HIT-1 - Tennessee Income Tax on Interest and Dividend Income.

Why You Need To Begin Estate Planning Now In 2021 Estate Planning How To Plan Estate Planning Attorney

There is no income tax on wages in this state making it one of the states with the lowest taxes.

. Estate and gift taxes the congressional budget office noted raised only about 14 billion in federal revenue in. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax exemption threshold of 25000 for children-in-law that wouldnt be considered income and you would be free to enjoy the inheritance without worrying about taxes. Self-Employed defined as a return with a Schedule CC-EZ tax form.

The median property tax rate for Tennessee homeowners is 727 per 100000 of assessed home. Capital Gains Taxes In some cases you wont receive cash as your inheritance but may instead receive it as an investment such as stocks bonds or even real estate. The tax rate depends on the relationship of the decedent and the beneficiaries or heirs.

The sales tax rate for groceries is 4. One state Maryland imposes both types of taxes but the estate tax paid is a credit against the inheritance tax so the total tax liability is not the sum of the two but the greater of the two taxes. Tennessee is a new edition to the list for 2021.

What other Tennessee taxes should I be concerned about. Tennessee Tax Relief provides a rebate check to property owners when they pay their taxes. The sales tax rate on food is 4.

TN ST 67-8-202. Tennessee had a separate inheritance tax which was phased out as of January 1 2016. Tennessee has no inheritance tax.

The states median property tax rate is the second-lowest in the country at only 395 per 100000 of home value 250000 home 988 in tax. The tax rate is. HIT-6 - Hall Income Tax Return - Electronic Filing.

HIT-2 - Hall Income Tax - Overview. They impose taxes on all estates worth 1 million or more. Tennessees Hall Tax an income tax on interest and dividend income but not wage income was phased down by one percentage point per year between 2016 and 2020.

1 online tax filing solution for self-employed. The highest estate tax rate in the country is in Washington at 20 percent. 350000 home 1383 in tax.

Pick-up tax is tied to federal state death tax credit. Tennessee offers property tax relief to eligible homeowners aged 65 or older disabled individuals and veterans or their surviving spouses. That adds up to an effective property tax rate of 064 meaning the average Tennessee homeowner pays just 064 of their homes market value in taxes annually.

The average effective property tax rate is 073 which is collected by counties and cities. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. Tennessee levies tax on other items outside of income.

Maryland is the only state that has both an estate tax and an inheritance tax. Plus all homeowners. The median amount of property tax paid statewide is 1220 per year.

HIT-4 - Hall Income Tax Rate. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. State tax - The general sales tax rate for most tangible personal property and taxable services is 7.

HIT-3 - Hall Income Tax Repealed Beginning January 1 2021. See all 24 articles Informal Conferences. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required.

However Pennsylvania unfortunately does levy an inheritance tax. It is only one of seven states that levies one. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. State single article - 275 on any single item sold in excess of 1600 but not more than 3200. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. Americas 1 tax preparation provider. Tennessee charges a lower tax rate for groceries but it is still one of just a handful of states that taxes grocery purchases.

The income tax rate reached 5 percent in 2020 upon certain revenue growth criteria being met. A few products and services such as aviation fuel or telecommunication services have different tax rates. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Whats the Tennessee Income Tax Rate. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. The Pennsylvania Inheritance Tax Return Form Rev-1500 must be filed within nine months of the date of death.

The state has been moving to be a zero income tax state which makes it attractive for retirees. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. The state tax rate varies by state for example Nebraska charges 1 18 inheritance tax depending on the amount inherited and Pennsylvania charges 45 15.

Maryland is the only state to impose both. The full table of Rhode Island estate tax rates is available on the. Tennessees inheritance tax is calculated more like an estate tax ie the tax does not vary based on the beneficiary.

The federal government has a gift tax that applies to gifts greater than 15000 a year. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

Twelve states and Washington DC. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. The inheritance tax is imposed on both residents and nonresidents who owned real estate and tangible personal property in Pennsylvania at the time of their death.

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. HIT-5 - Hall Income Tax Return Due Date. Impose estate taxes and six impose inheritance taxes.

The two states that have the lowest threshold for estate taxes are Massachusetts and Oregon. Therefore the Tennessee income tax rate is 0. If the inheritance tax is paid within three months of the decedents death a 5 discount may apply.

Other taxation applied to inheritance. A tax rate of 08 applies on amounts of at least 40000 but less than 90000 and tax rates increase sequentially from there. Effective Real Estate Tax Rate.

Texas doesnt have an income tax but it does levy a state sales tax of 625 percent and local jurisdictions can levy up to 194 percent in. Homeowners in Tennessee pay some of the lowest property taxes in the country. Estate and Inheritance Tax.

Tennessee is one of eight states that does not levy any individual income tax at all. State Income Taxes and Federal Income Taxes.

Why You Need To Begin Estate Planning Now In 2021 Estate Planning How To Plan Estate Planning Attorney

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

State Local Property Tax Collections Per Capita Tax Foundation

Thinking About Moving These States Have The Lowest Property Taxes

Kids Corner Chester County Solid Waste Authority Pa Chester County Solid Waste Chester

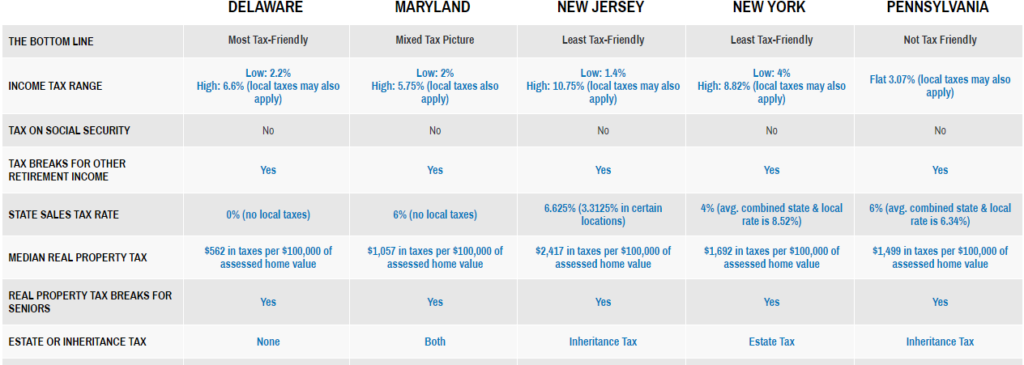

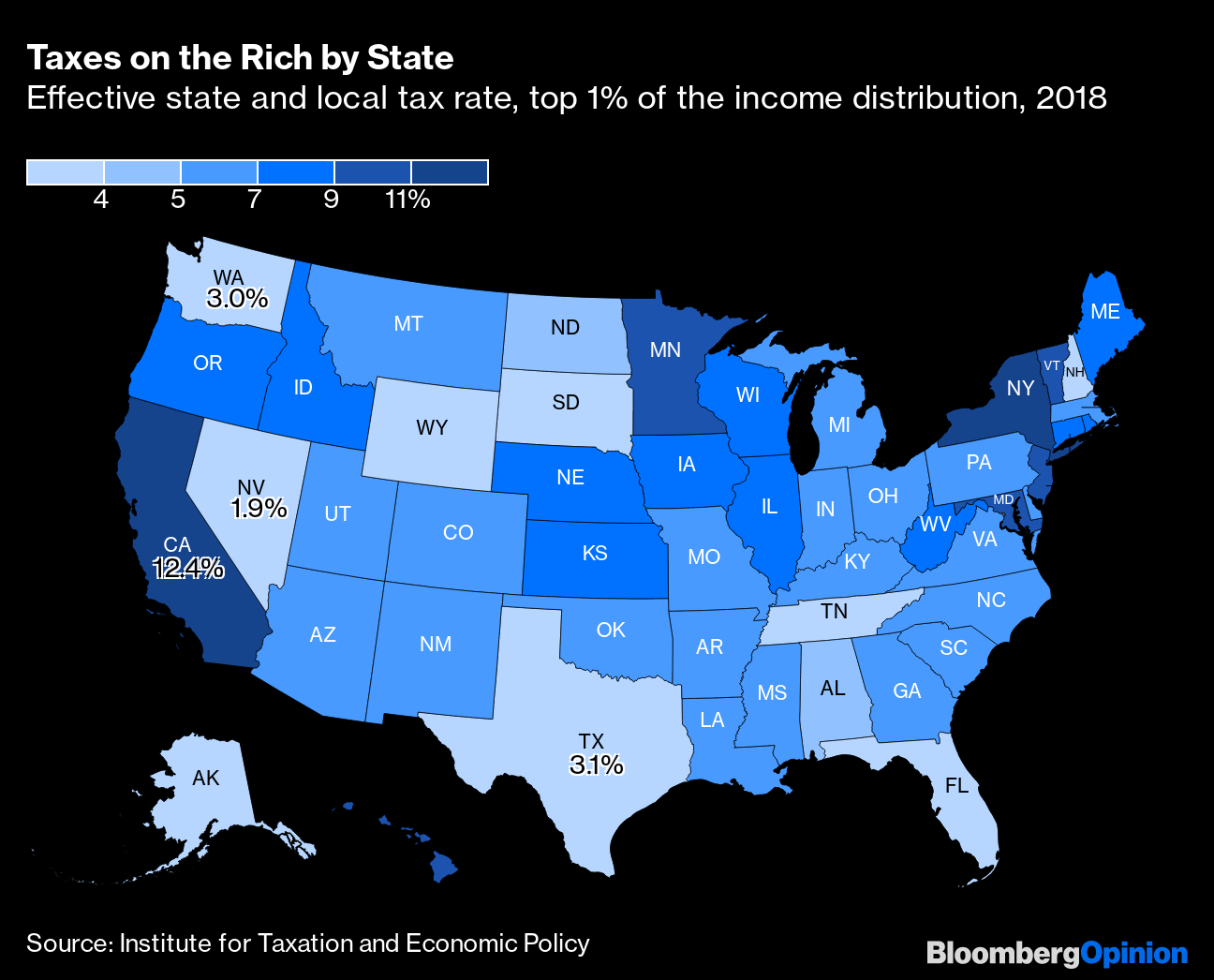

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

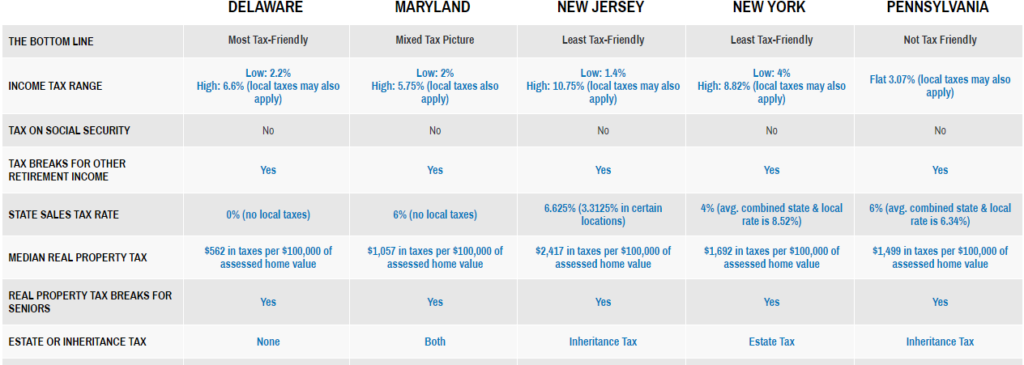

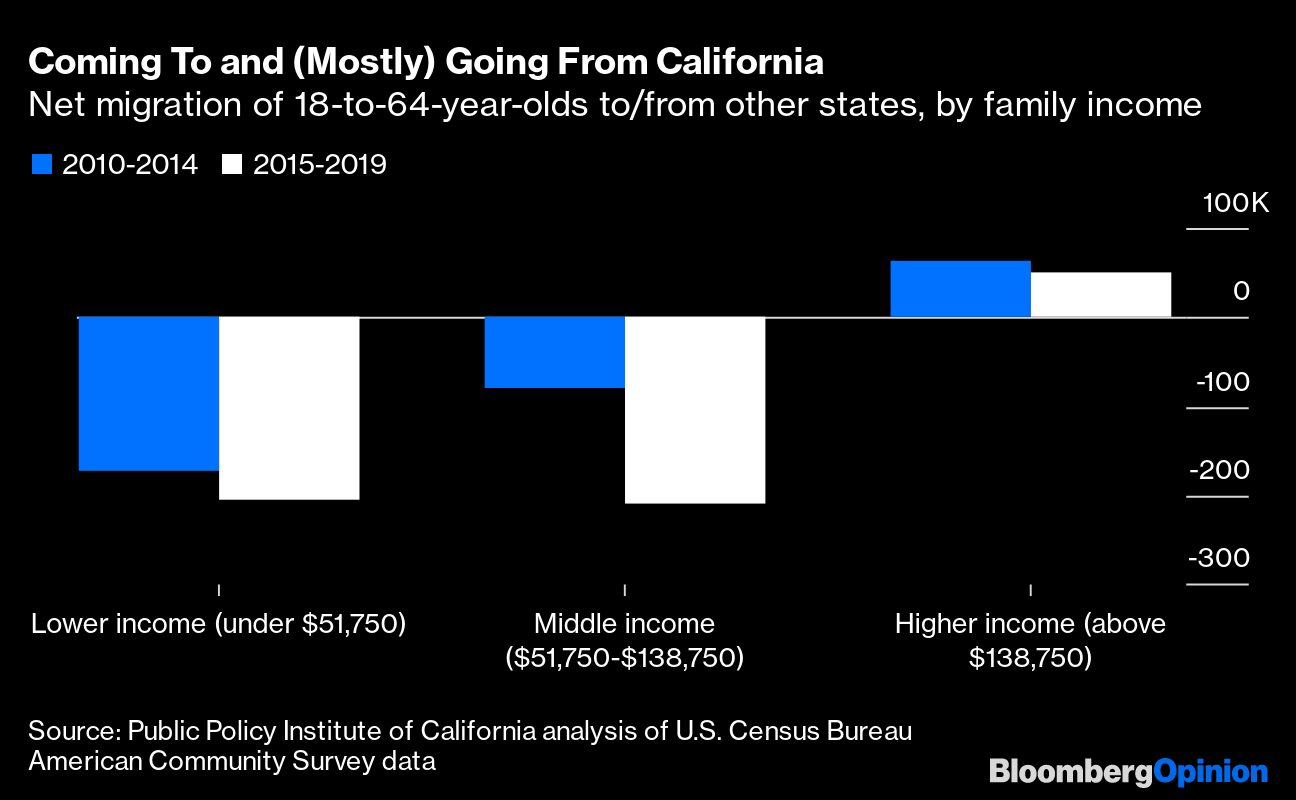

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

What Is Boot In A 1031 Exchange Youtube Exchange One Piece Episodes Carrie Anne Moss

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Property Tax Appeals Process Property Tax Estate Tax Tax

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

How Bill Gates And Warren Buffett Estates Will Pay Zero Estate Tax Https Youtu Be Euj0ncxvmpq Estate Tax Estate Planning Checklist Warren Buffett

How To Avoid Capital Gains Tax When You Sell A Rental Property

6 Over The Top Luxury Resorts That Are Worth The Price Tag Best All Inclusive Resorts All Inclusive Resorts Inclusive Resorts

Property Tax Appeals Process Property Tax Estate Tax Tax

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global